Diversification Isn’t Optional. It’s Survival.

In a world where markets move faster than headlines, careers shift overnight, and global events can disrupt entire industries within days, the concept of financial stability has fundamentally changed. The old belief that one steady job, one retirement plan, or one investment type can carry you through life is no longer realistic. Today, diversification isn’t a strategy reserved for the wealthy, the educated, or the investment-savvy—it is the baseline requirement for anyone who wants to survive financially, let alone succeed.

Diversification has become a lifeline in an unpredictable economic landscape. It shields your finances from volatility, spreads out your risk, and creates multiple pathways to grow wealth. Think of diversification the way sailors think of lifeboats. You hope you never need them, but when the storm hits, they’re the only reason you stay afloat.

1. Economic Uncertainty Is the New Normal

There was a time when economic cycles were predictable. Recessions came every few years, then recovered with steady growth. But modern markets don’t move in slow cycles anymore—they react instantly to technology shifts, geopolitical tensions, pandemics, inflation spikes, consumer behavior changes, and global supply chain disruptions.

One headline can drop the stock market.

One conflict can alter global trade.

One recession can wipe out entire industries.

The pace of change is no longer measured in decades—it’s measured in weeks. That’s why relying heavily on a single income source, a single investment strategy, or a single market is a risk most people can’t afford to take. Diversification reduces the impact of these sudden shifts by ensuring you are not overly exposed to one economic variable. When one sector struggles, another can remain stable or even grow, allowing your financial ecosystem to remain intact.

2. No Single Asset Class Performs Forever

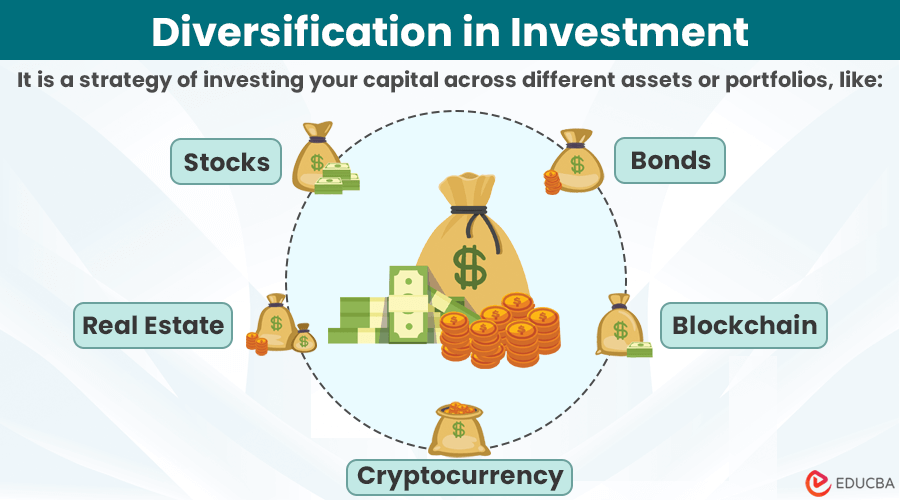

Every asset class—stocks, bonds, real estate, commodities, crypto—has its seasons. Some thrive during economic expansion; others do well during downturns. The problem is that no one can predict, with certainty, which asset will perform best next year or next decade.

Stock markets can soar for years, then crash violently.

Real estate can appreciate steadily, then stagnate.

Bonds can offer stability but struggle during inflationary periods.

Cryptocurrencies can rise exponentially, then tumble dramatically.

History shows that the top-performing asset class changes constantly. Not only year to year, but sometimes month to month. Diversification solves this by allowing you to capture gains from multiple sources while insulating you from unpredictable declines. It’s not about picking the perfect asset—it’s about constructing a portfolio that performs well across different conditions.

3. Income Diversification Is Your Defense Against Job Instability

Relying on a single paycheck is one of the most underestimated financial risks. The modern job market is more competitive, automated, and volatile than ever. Companies restructure. Industries get disrupted. Roles become obsolete. Even stable careers face downsizing pressures.

Diversifying your income streams is no longer optional—it’s a financial necessity.

- A main job for stability

- A side business or freelance work for flexibility

- Investment income from dividends, interest, or real estate

- Passive income streams from digital products or royalties

Each income stream becomes a support pillar. If one falls, the whole structure doesn’t collapse. And the more diversified your income, the more power you have to walk away from toxic jobs, negotiate better positions, or pursue long-term goals without fear of financial instability.

4. Diversification Lowers Risk Without Lowering Opportunity

One of the biggest myths is that diversification dilutes your opportunity to gain wealth. This isn’t true. In fact, it protects your future by increasing the likelihood that some portion of your portfolio will perform strongly in any economic climate.

Imagine putting all your savings into a single stock because you believe it will rise. It might—but it might also collapse, taking your entire future with it. But if you spread that money across multiple stocks, sectors, and asset classes, one failing investment becomes a minor issue, not a catastrophe.

Diversification does not eliminate risk entirely—nothing can—but it reduces the severity of losses. It creates smoother returns over time and allows compounding to work more effectively. With consistent performance across different assets, your wealth grows steadily instead of swinging wildly with market conditions.

5. Geographic Diversification Protects You from Local Instability

People often underestimate how much their wealth depends on the stability of their country. Inflation spikes, currency devaluation, political shifts, and economic slowdowns can all threaten financial security.

Geographic diversification protects you from being overly dependent on one economy. This can include:

- Investing in global stock markets

- Holding foreign currencies

- Owning digital assets

- Working online for international clients

- Investing in real estate abroad

When you spread your financial exposure across multiple regions, you decrease the likelihood that a local crisis will harm your overall wealth.

6. Diversifying Your Skills Increases Your Economic Value

Financial diversification isn’t just about money—it’s about capability. In a fast-changing world, your skills may become obsolete if you don’t expand or update them. Diversifying your skillset ensures that you remain employable, adaptable, and valuable.

- Technical skills

- Communication skills

- Digital proficiency

- Leadership and problem-solving

- Sales, marketing, or entrepreneurial knowledge

Skills are assets. They generate income. They open doors. They create resilience. The more you have, the more opportunities you can seize.

7. Diversification Builds Psychological Strength

Financial pressure is one of the biggest sources of stress in modern life. When all your income, investments, or future depends on a single source, the fear of losing it can be mentally draining. Diversification has a powerful psychological benefit: it creates security through redundancy.

Knowing that you have multiple income streams, multiple assets, and multiple opportunities allows you to make smarter decisions with a clear mind rather than fear-driven ones. It reduces anxiety and creates confidence—two qualities essential for long-term financial success.

8. The Goal Isn’t Perfection—It’s Protection

Some people avoid diversifying because they’re afraid of doing it wrong. They wait, research endlessly, or hesitate until the “perfect” investment appears. But the truth is, perfection isn’t the goal. Protection is.

A diversified approach—no matter how simple—is superior to doing nothing. Even small steps like investing in a broad index fund, building a basic savings buffer, or starting a tiny side income create meaningful safety nets.

You don’t need to become an expert. You just need to start.